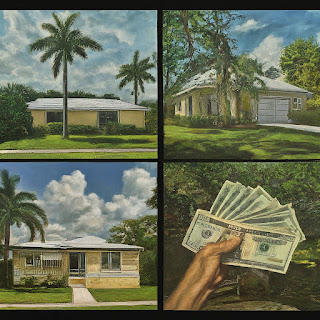

WE BUY HOUSES CASH! GET A FAST NO OBLIGATIONS CASH OFFER! SUBMIT YOUR PROPERTY BELOW OR CALL OUR 24 HOUR RECORDED MESSAGE FOR MORE INFO!

NO ONE WILL ANSWER OR TRY TO SELL YOU ANYTHING

|

Determining the Best Way to Sell Your Home For Cash in Florida

Navigating through the intricate process of selling a property can be daunting, especially when the goal is to sell your house fast in Florida. There is a vibrant market filled with diverse options and among them, aligning with a cash home buyer becomes a compelling alternative. Selling to cash buyers accelerates the selling process, eliminating numerous complications that could delay or prohibit the sale. It’s the optimal route for homeowners saying ‘I need to sell my house fast’.

Florida cash home buyers such as CashBuyersInternational.com have established a professional reputation for speed and convenience. Being immediate buyers, they don't just facilitate the sale, they are the end buyers which crucially means that the homeowner can bypass the traditional market hurdles. Homeowners minquiring about a cash offer can phone them on 754-610-3036 or send an email to cashbuyersinternational@gmail.com. They consistently bridge a crucial gap in the market and make the idea of 'sell your house fast' in Florida a viable reality. Undoubtedly, recognizing and capitalizing on their role in the market is crucial in determining the best way to sell your home in Florida.

Recognizing the Benefits of Selling Your House Fast for Cash

If you want to sell your Florida home quickly and efficiently, opting for a direct sale to a company that specializes in cash purchases can offer myriad benefits. For instance, CashBuyersInternational.com is a professional company in Florida that has carved out a niche in the market for their uncomplicated and prompt process. They buy houses in Florida for cash, eliminating the need for traditional bank financing, which can delay the transaction. You'll have no need to stress about buyer mortgage contingencies or the deal falling through due to financing issues.

When urgency is crucial, time is of the essence, and you may feel like heralding 'sell my house fast'. In such cases, a cash buyer like CashBuyersInternational.com is the perfect fix. Their ability to close the deal fast comes as a relief to those who desperately need to sell their house for cash. By choosing to sell your house fast to this credible and professional company in Florida, you can alleviate worries about lengthy property listings and home showings. Get in touch with them at 754-610-3036 or drop an email at cashbuyersinternational@gmail.com to kickstart your expedited Florida house sale.

Attracting Cash Home Buyers in Florida

Navigating the Florida real estate market can be complex, but one surefire method to streamline the selling process is to attract a cash home buyer. One renowned company in Florida seeking such opportunities is CashBuyersInternational.com. Offering fast and efficient transactions, this professional home buyer is always on the lookout for unique selling possibilities. They ensure you can sell your house fast, making cash in Florida an attractive option. Besides its speed and simplicity, selling to a cash home buyer also removes the need for costly repairs and fees, which can make all the difference to a homeowner looking to sell.

CashBuyersInternational.com is one such company that doesn't just buy houses in Florida - they provide homeowners the opportunity to sell their house for cash in Florida, free of any stress or setbacks typically associated with conventional home sales. Renowned amongst companies that buy houses, they provide solutions tailored to fit individual needs. Their established reputation means you can trust them when you're looking to sell your house in Florida. Reach out to them, quote "sell my house fast Florida", and experience the difference of selling houses in Florida fast. You can communicate with them through their phone number "754-610-3036" or email them at "cashbuyersinternational@gmail.com". Opt for a cash home buyer and experience a hassle-free and speedy sale for your house.

Understanding Why Companies Buy Houses for Cash

Companies opting to buy houses for cash offer a unique value proposition to homeowners seeking to sell their property quickly. This mode of operation is particularly popular with professional property buyers, like CashBuyersInternational.com, that buy properties in Florida. What sets these companies apart is their ability to streamline the transaction and minimize the effort required by the seller. This means an individual wanting to sell their house fast doesn't have to worry about lengthy, traditional sales processes or expenses such as realtor fees.

The appeal of a cash in Florida transaction also lies in its simplicity. Sellers can evade the complexities of financing, which can expedite the sales process considerably. Not only does this benefit the seller, but the buyer, too. As a cash buyer, a company like CashBuyersInternational.com - who can be reached at 754-610-3036 or via email at cashbuyersinternational@gmail.com - has an advantage. The speed and assurance that accompanies a cash transaction position them as compelling Florida cash home buyers in the market. Therefore, if you want to sell your Florida house fast and avoid the typical hassles associated with property sales, considering a Florida cash home buyer might just be the perfect solution.

Preparing Your Florida Home for a Fast Sale

For Florida homeowners eager to secure a swift sale, appropriate preparation cannot be understated. Initiating preliminary home improvements can indeed ensure you sell your Florida house fast. Selling your home efficiently demands a keen understanding of the local market and competitors; this includes understanding the criteria of companies that buy houses. It is also instrumental to tailor your home selling approach to attract buyers seeking properties in Florida, highlighting unique attributes that set your place apart.

One such professional company operating in Florida is CashBuyersInternational.com. With a deep bank of knowledge and extensive industry experience, this organization is poised to offer competitive terms for those wishing to sell their house for cash in Florida. If you frequently find yourself thinking, "how do I sell my house fast?" or "I need to sell my Florida home quickly," do not hesitate to reach out to them. You can contact them via phone at 754-610-3036 or email at cashbuyersinternational@gmail.com. Their commitment to providing swift, satisfactory transactions ensures optimal results for those looking to sell their Florida home quickly.

Maximizing Cash Offers for Your Florida House

Leveraging the burgeoning real estate market in Florida can lead to lucrative avenues for homeowners who want to sell their properties. A proficient way to sell your property expediently is to consider cash offers, which can differentiate a routine sale from a swift transaction. A prime example of this is the services offered by the reputed real estate company, CashBuyersInternational.com. This reputable firm is renowned in the region for their capability to quickly buy homes, further offering homeowners an immediate solution when they are determined to sell their homes rapidly.

Recognizing the distinctive clientele of buyers in Florida, who are persistently looking for properties, CashBuyersInternational.com is rooted in a simple belief- they buy houses in any condition. Firmly committed to ensuring that their clients' unique needs are met, they provide a supportive environment for homeowners seeking an instant cash solution when looking to sell a house promptly. For any homeowner who intends to sell your home fast, they can contact CashBuyersInternational.com via phone at 754-610-3036 or email at cashbuyersinternational@gmail.com, to set forth their journey through the effortless process which only this professional property buyer in Florida can offer. The ability to offer cash for homes, irrespective of its condition, empowers homeowners to maximize profits and ease out the process of selling their homes in Florida.

Connecting with Reputable Cash Home Buyers in Florida

Navigating the labyrinth of a property sale could be bewildering, particularly for homeowners who wish to sell their homes promptly and without any hitches. Thankfully, a viable solution exists. With burgeoning cash home buyers in Florida such as CashBuyersInternational.com, you have the opportunity to expedite the entire process, selling your property in Florida without having to traverse the typical bottlenecks of traditional home selling. CashBuyersInternational.com, as the name suggests, is a reputable cash home buyer in Florida, easing the way for you to sell your home.

The advantages of selling to this kind of a buyer are manifold. Not only do these companies buy houses cash, but they also furnish a no-obligation cash offer – ensuring transparency and brevity in the transaction. Therefore, if thoughts about "I want to sell my house and sell it quickly" cross your mind, CashBuyersInternational.com could be your key to sell your Florida house fast. The procedure is simplified further with their crystal-clear communication channels. You may reach out to them directly via their phone number 754-610-3036 or drop an email at cashbuyersinternational@gmail.com to kickstart the process. Connecting with a credible cash buyer in Florida has never been easier, making it a compelling way to sell your home.

Navigating the Process of Selling Your House Fast in Florida

Successfully navigating the process of selling your house fast in Florida requires astute preparation and engagement with credible buyers. As this endeavor begins, the focus lies in effectively making your home attractive to potential buyers primarily interested in buying houses in the region. An appealingly staged, well-maintained house is more likely to garner interest and incite compelling cash offers for your house, enabling you to sell your house at a competitive price.

One essential part of the process is choosing a reputable cash home buyer who employs transparent methods and fair practices. An ideal recommendation in this regard is CashBuyersInternational.com, a professional property buying company that specializes in buying Florida houses fast and paying in cash. The company is known for its hassle-free processes and credible history, leaving clients satisfied with the services provided. Those interested in engaging their services can reach them directly through their contact number, 754-610-3036, or via email at cashbuyersinternational@gmail.com. Trusting such a company can undoubtedly facilitate your desire to sell your home quickly, ensuring you receive a fair cash offer for your house.

Leveraging Instant Cash Offers from Florida Home Buyers

In the specialized realm of real estate transactions, Florida cash home buyers have emerged as an impactful force, notably fanning the trend of rapid home sales. Housing markets have seen a shift towards quick transitions courtesy of these cash buyers. When you are pondering, "How can I sell my house fast?" or "I need to sell my house fast in Florida," a cash buyer's offer can be an advantageous route to explore. These buyers streamline the rigors of the conventional home sale methodology, quickening the pace from listing to final closing.

One such professional entity facilitating these swift transitions in the Florida real estate market is CashBuyersInternational.com. As a reputable real estate investment company in Florida, they seek out homeowners who want to sell. They are dedicated to promoting simplicity and efficiency for those wishing to sell a house without the common hitches and delays associated with traditional selling methods. Their presence heightens the availability of rapid cash in Florida, an irresistible attribute for motivated sellers. To unlock this quick sale advantage offered by cash buyers, homeowners can contact CashBuyersInternational.com via phone at 754-610-3036 or email at cashbuyersinternational@gmail.com.

Considerations for Selling Your Property in Florida to a Cash Buyer

Selling your property in Florida to a cash buyer can be an appealing method for a swift and hassle-free transaction. The concept of a cash offer is simple; buyers, such as CashBuyersInternational.com, put forward a fair cash offer without the need for a mortgage loan. Holding a strong reputation as a seasoned property buyer in Florida; this particular company has an uncomplicated way to sell your Florida home, often presenting homeowners with a competitive and fair cash offer. Their method eliminates the traditional hurdles of selling a property, such as waiting for prospective buyers to secure a mortgage or dealing with the often-lengthy appraisal process.

Before you choose to sell your Florida house for cash in Florida, understanding the process and its benefits is key. With companies like CashBuyersInternational.com, they buy houses in Florida directly, cutting out the middlemen and the associated costs. The process renders a fast cash solution that can be particularly useful in situations requiring a quick transaction such as relocating or settling an estate. You can reach out to them via their contact number, 754-610-3036, or by email at cashbuyersinternational@gmail.com, not only do they buy homes, but they're willing to buy your house in any condition, which further simplifies the selling process. However, it's wise to consult with real estate professionals or legal advisors to ensure you're getting the best deal for your particular circumstances.

Optimizing Your Florida House for a Fast Cash Sale

In the realm of real estate, positioning your home for a speedy sale can often feel like a daunting task. This especially holds true when you are looking to sell a property swiftly in a competitive market such as Florida. However, homeowners can breathe a sigh of relief knowing there are cash home buyers like CashBuyersInternational.com who are ready and willing to buy houses in any condition. Working with companies such as this, it's indeed possible to sell your home quickly and at a fair price.

CashBuyersInternational.com, with their professional property buying services, is known for making instant cash offers, thereby helping homeowners trying to sell quickly to expedite the process and ensure a smooth transaction. They understand the potential challenges that come with selling a home in Florida, and they work to counteract those by extending an offer cash on the table the moment they decide to buy. To get a cash offer or understand how to prep your home for cash sale, homeowners can easily reach the team via their contact number 754-610-3036 or send an email to cashbuyersinternational@gmail.com. The team’s expertise along with a fast, efficient, and transparent process makes them a reliable cash home buyer in Florida.

Avoiding Common Pitfalls When Selling Your Home Quickly in Florida

In the dynamic Florida real estate market, enticing a fast for cash offer for your home is a prospect that resonates with many homeowners. This surrounds the avoidance of drawn-out dealings typically associated with traditional home sales, like staging open houses or enthralling potential buyers. Instead, the focus shifts to the desire to sell their homes promptly, evading unnecessary delays. The prospect of selling your Florida house quickly for cash eliminates the need for time-consuming repairs and upgrades as you can navigate the sale of your home as-is. A company that perfectly understands this process is CashBuyersInternational.com, having leveraged our extensive background to assist numerous homeowners across Florida.

Naturally, transacting your home fast for cash is not without its challenges. Potential stumbling blocks can deter homeowners who choose to tread the path of a speedy cash sale. Luckily, an experienced company can help you sell your home at an optimal price, circumventing these potential pitfalls. That's where CashBuyersInternational.com comes in, underpinned by their reputation as one of the professional property buyers in Florida. Their ability to provide cash for your home promptly, while ensuring the highest level of professionalism and customer service is incomparable. For further information or queries, you can reach them via phone at 754-610-3036 or email at cashbuyersinternational@gmail.com. In conclusion, when handled correctly, selling your Florida home quickly for cash can be a seamless, profitable process.

Here are some tips to avoid common pitfalls when selling your Florida home quickly for cash:

• Understand the Market: Before you decide to sell your house, it's crucial that you understand the current real estate market in Florida. This will help you set a competitive price and increase your chances of attracting serious buyers.

• Choose the Right Buyer: Not all cash buyers are created equal. It's important to choose a reputable company like CashBuyersInternational.com that has a solid track record of buying homes fast for cash in Florida.

• Get Your Home Appraised: While selling your home as-is can save time, getting it appraised can give you an idea of its actual value. This way, you won't end up underselling your property.

• Avoid Overpricing: Setting an unrealistic price tag on your home can deter potential buyers and prolong the sale process. Be realistic about what people are willing to pay based on similar properties in your area.

• Be Transparent: Always be upfront about any issues with the property. Honesty is always appreciated by buyers and could potentially save you from legal troubles down the line.

Remember, while selling quickly for cash may seem appealing due to its speed and convenience, it’s essential not to rush into decisions or overlook key details that could cost money later on.

Working with a Florida Company that Buys Houses in Any Condition

In the realm of real estate transactions, several companies have emerged that specialize in the acquisition of properties under varying conditions. One such entity is CashBuyersInternational.com, a distinguished entity amongst the companies that buy houses. As an expert in home selling, they completely comprehend that a prospective buyer may not always be open to purchases that call for renovations or refurbishment. Therefore, if you are deliberating, "how to sell my house fast in Florida," even if it requires a little tender loving care, casting an eye towards such companies may alleviate your concerns. It's worth considering to sell to a cash buyer like CashBuyersInternational.com, who not only buy houses cash but also streamline the process for home sellers in Florida.

CashBuyersInternational.com embodies the core values of integrity, transparency, and efficiency, which have contributed significantly to their reputation in the Florida property market. They operate with the philosophy that every home, regardless of its condition, has inherent value. As respected home buyers in Florida, they present a no-obligation cash offer for your home without the usual contingencies present in traditional real estate transactions. This results in a swift and efficient process to sell your house in Florida. To connect with CashBuyersInternational.com or to request a cash offer for your Florida house fast, you may reach out to them at 754-610-3036 or via email at cashbuyersinternational@gmail.com. They are always ready to engage in transactions where they can pay cash for properties, providing further ease to sellers.

Exploring the Pros and Cons of Selling Your Florida Home to a Cash Buyer

Selling your Florida home to a cash buyer can indeed be the fastest way to sell, having its own set of advantages that appeal to homeowners looking for a swift and uncomplicated process. A clear pro is that businesses like CashBuyersInternational.com, reputable cash buyers located in Florida, can expediently expedite the transaction, reducing the time and stress involved in a traditional house sale. Homeowners send their house to us, and the property in Florida quickly transitions into a liquid asset, often within a week of first contact. In addition, given that ‘we buy properties in Florida’ is the core ethos of the company, any concerns over financing falling through, a common concern within traditional property sales, are immediately reduced.

That foresaid, selling to a cash buyer in Florida is not without potential drawbacks which homeowners ought to carefully consider. First and foremost among these is the potential for receiving less than the market value for your property—the speed and convenience of being able to tell prospective buyers "sell your home quickly to us" inevitably comes with a tradeoff. Secondly, homeowners could sell at a higher price by listing their property on the open market, although this route does not possess the same promptness and assuredness of working with a steady and reliable cash buyer like CashBuyersInternational.com. For more personalized advice, prospective sellers can engage with the team directly at 754-610-3036 or via email at cashbuyersinternational@gmail.com.

Capitalizing on the Demand for Homes in Florida from Cash Buyers

Given the increasing demand in Florida's real estate market, many individuals and companies are actively looking to buy properties. Perfectly suited for homeowners in Florida are those who find themselves saying, "I need to sell my house" quickly. These buyers can be a valuable asset in helping you sell your house fast, especially if your house needs immediate attention or repairs. The growing interest from these buyers highlights a popular way to sell a house quickly and advantageously.

One company that stands out in the midst of this rising market demand is CashBuyersInternational.com. Not only do they specialize in buying houses in any condition, this professional outfit is recognized for their dedication to providing homeowners with straightforward and efficient transactions. So if you are in a situation where you need to sell quickly or finding yourself thinking, "I want to sell my home," contact CashBuyersInternational.com at 754-610-3036 or reach out via email at cashbuyersinternational@gmail.com. They can help increase the value of your home and make your home attractive to more potential buyers by offering to buy your home fast for cash. By working with such professional home-buying companies, you can avoid the traditional pitfalls of the real estate market, optimally capitalizing on Florida's demand for homes from cash buyers.

Strategies to Encourage a No-Obligation Cash Offer for Your Florida House

Without doubt, a rapid and judicial approach can prove beneficial for homeowners looking to sell their properties quickly in Florida. One of the most assuredly successful strategies entails aligning with experienced cash buying companies, such as CashBuyersInternational.com. By choosing to work with such proficient outfits, homeowners not only speed up the transaction process but also ensure a fair cash offer for their house. CashBuyersInternational.com is renowned for their competence in acquiring houses in Florida fast, making them an ideal partner for anyone looking to sell swiftly and worry-free.

Selecting a proficient way to sell your house is crucial to maximize financial returns and minimize stress. Capitalizing on companies that facilitate express dealings like, "sell my house fast," could be a deciding factor in your selling experience. CashBuyersInternational.com stands out as one such enterprise, dedicatedly seeking to buy your home with a fair cash offer. With their smooth, streamlined processes, an offer on your home can be on the table in no time, eliminating the lengthy waiting periods associated with traditional house selling methods. You can reach out to them anytime at 754-610-3036 or via email at cashbuyersinternational@gmail.com to start the rapid transaction.

Utilizing a Reputable Cash Buying Company to Sell Your Florida House Fast

Relying on a distinguished cash buying company such as CashBuyersInternational.com can simplify and expedite the process of selling your Florida home. As a professional property buyer in Florida, CashBuyersInternational.com has crafted a streamlined process for home acquisition, removing the typical delays and roadblocks that often occur with traditional home sales. Their specialization in the fast cash acquisition of properties makes for a quick and easy transition, offering a viable, efficient solution to those in need of expedient transactions.

Being able to connect with this caliber of professionals directly simplifies the selling process. Through direct contact methods such as calling 754-610-3036 or sending an email to cashbuyersinternational@gmail.com, sellers have immediate access to a team of experts dedicated to facilitating a swift and smooth property sale. CashBuyersInternational.com’s commitment to professionalism and customer-oriented solutions has positioned it as a leading entity in the cash buying sector within Florida. They have managed to combine speed, convenience, and fair market offers into an attractive package for potential sellers. This reimagines the conventional approach to selling homes, making it particularly beneficial for those sellers seeking a fast sale for their Florida house.

FAQs

What are some key considerations to take into account when selling my Florida home to a cash buyer?

There are several considerations. First, research the reputation of the cash buying company to ensure they are trustworthy. Second, understand the value of your home so you are prepared to negotiate the best price. Lastly, be aware of any legal implications and ensure all paperwork is correctly completed.

Why should I choose to sell my Florida house for cash?

Selling your house for cash can have several benefits including faster transactions, fewer complications with financial institutions, and the potential to sell your home as-is, which can save you money on repairs or upgrades.

How can I attract cash home buyers in Florida?

Certain strategies can help attract cash buyers. This includes pricing your house competitively, highlighting its best features, and ensuring it is in good condition. Additionally, marketing your property effectively can help to reach a wider audience of potential buyers.

How does the process of selling my house fast for cash work?

Generally, the process involves reaching out to a reputable cash buying company who will then evaluate your home. They will then make a no-obligation cash offer. If you agree to the offer, the transaction can be completed within a few days or weeks.

What can I do to maximize the cash offer for my Florida house?

To maximize your cash offer, ensure your home is well-maintained and presentable. Highlight any upgrades or unique features your property may have. It's also beneficial to understand the real estate market conditions in your area to help with negotiations.

Are there any common pitfalls to avoid when selling my house fast in Florida?

Yes, it's crucial to avoid rushing into accepting the first offer without understanding its value. Also, ensure the cash buying company is reputable to avoid scams or unfair terms. It's always recommended to seek legal advice before finalizing any sales contract.

What are the benefits of working with a Florida company that buys houses in any condition?

Companies that buy houses in any condition offer convenience and speed. They can be particularly beneficial if you need to sell quickly or if your house requires significant repairs, as you can sell the house as-is without having to invest time and money into fixing it up.

What are the pros and cons of selling my Florida home to a cash buyer?

Pros include faster sales process, less paperwork, and the ability to sell as-is. Cons may include potentially receiving less money than if you sold through a traditional real estate market, and the potential risk of scams if not dealing with a reputable company.